Stablecoin major Circle has announced its Q3 2025 earnings, only the second earnings it has reported as a publicly traded company, with strong top-line results and growth in its network.

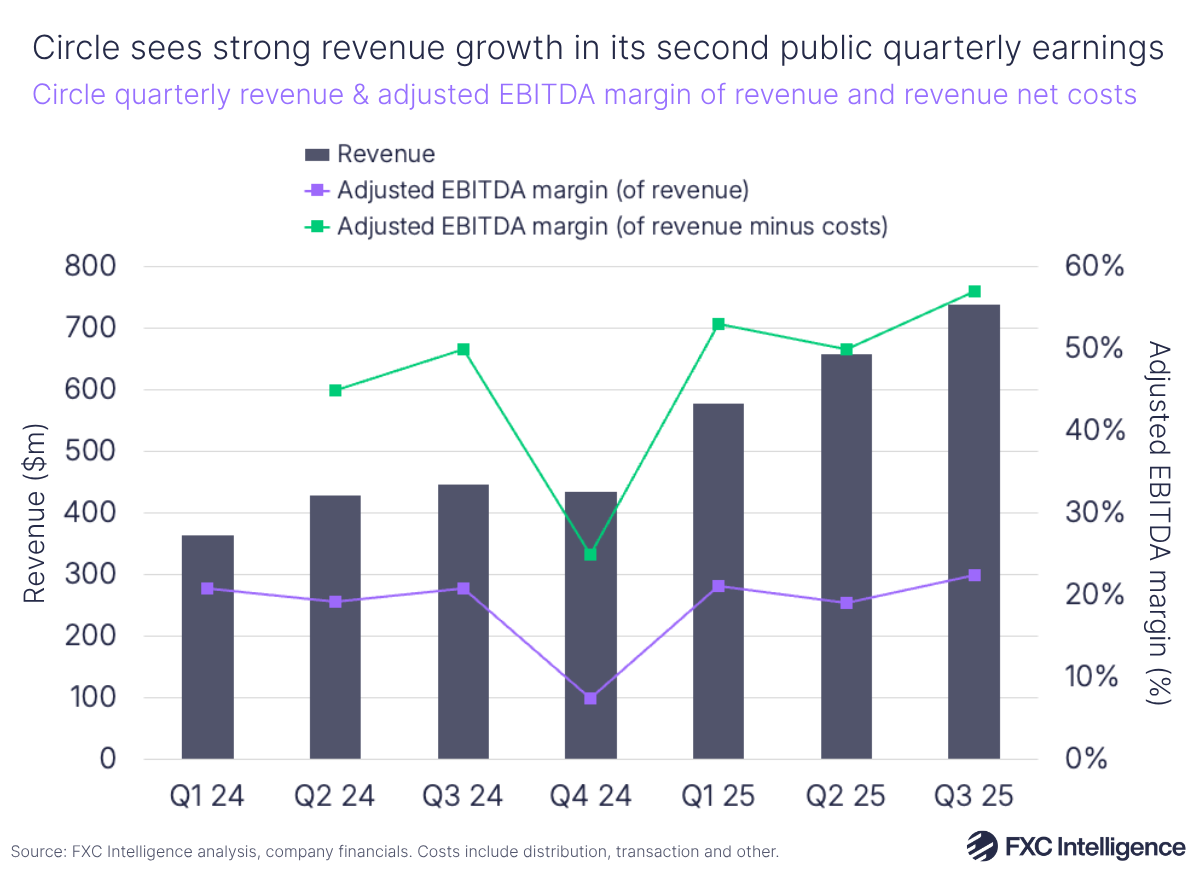

The company reported a 66% YoY increase in revenue to $740m, while revenue less distribution, transaction and other costs increased by 55% YoY to $292m. The company’s adjusted EBITDA also grew 78% YoY to $166m.

This translates into an adjusted EBITDA margin, when calculated as a share of revenue, of 23% – two percentage points higher than a year ago. Alternatively, using Circle’s preferred approach of calculating adjusted EBITDA as a share of revenue less costs provides an adjusted EBITDA margin of 57% – seven percentage points higher than a year ago.

USDC growth buoys Circle’s rising revenue

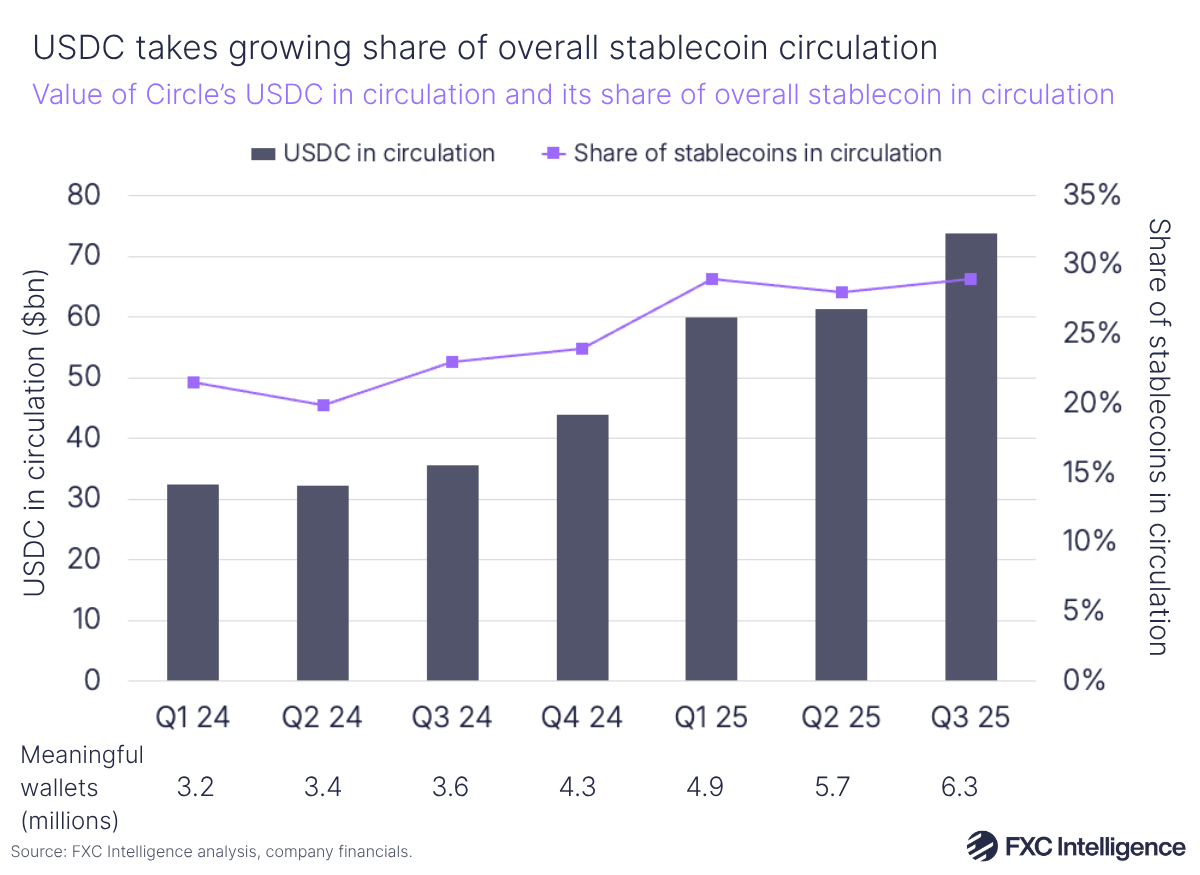

The company was particularly keen to highlight growth in its USDC stablecoin, which drives the vast majority of its revenue via reserve income. The company saw USDC in circulation rise by 108% YoY to $73.7bn, aided by tailwinds from the passing of the US GENIUS Act. The stablecoin, which is the second largest globally after Tether’s non-GENIUS-compliant USDT, has also taken a greater share of the overall market in the last year. While in Q3 2024 USDC’s share of stablecoins in circulation stood at 23%, in Q3 2025 this had risen to 29%.

There are also a greater number of individuals and organisations holding USDC than there were a year ago, with the company reporting the number of meaningful wallets – that is, on-chain digital asset wallets holding at least $10 in USDC – had risen 77% YoY to 6.3 million globally.

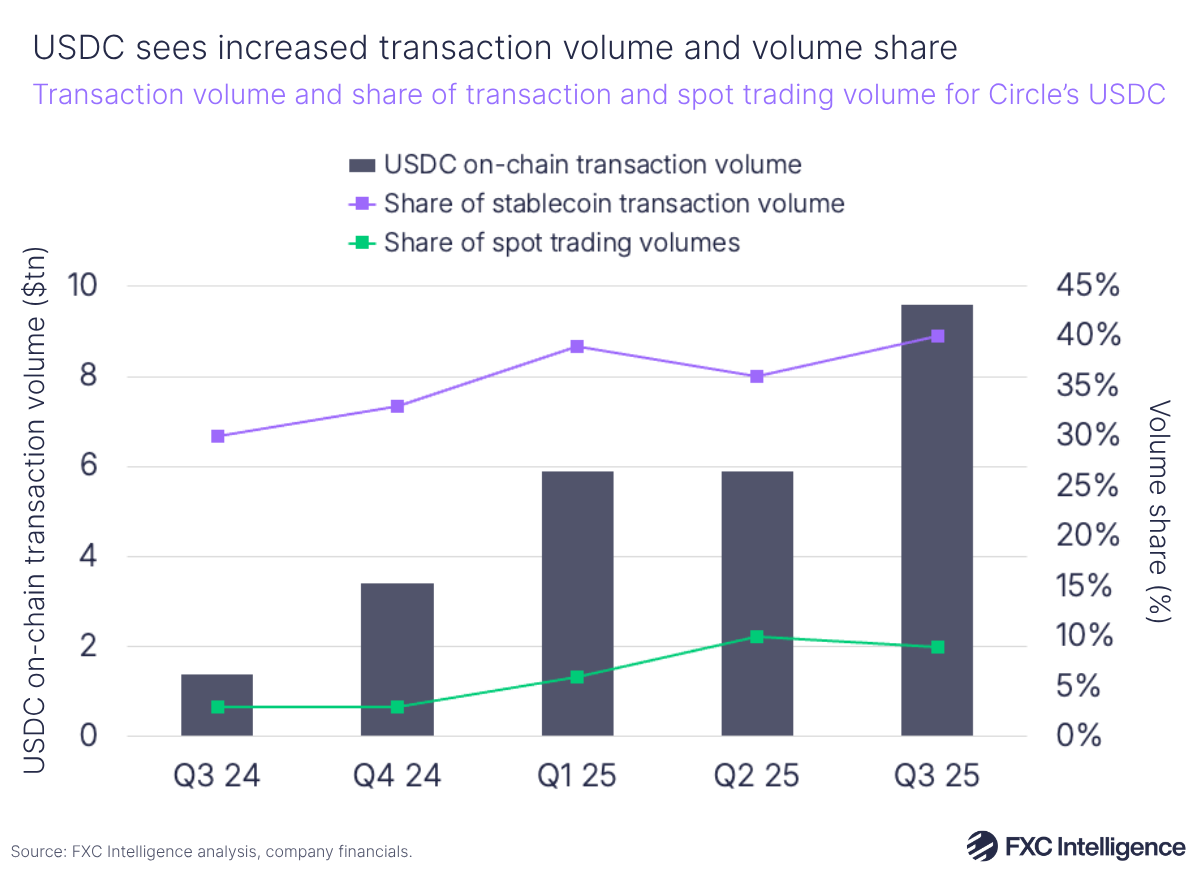

Further, the company has seen greater rises in the volume of on-chain transactions using USDC, which in Q3 2025 climbed 586% YoY to $9.6tn. This has also seen USDC’s share of all stablecoin transactions climb by 10 percentage points year-on-year to 40%, while the company has also seen USDC take a greater share of spot trading volumes.

Increased ownership and use of USDC is key to Circle’s growth because the company makes the majority of its money from the interest on the reserves that underpin the stablecoin, although the company believes there is significant further growth ahead.

Commenting on USDC’s transaction growth, CEO Jeremy Allaire highlighted the “inherent and increasing velocity and efficiency of using USDC as a medium of exchange”, adding that “this increasing velocity of money is a crucial feature of the internet financial system”.

This forms part of Circle’s wider thesis on its role in the future development of the online financial ecosystem, with Allaire arguing that the emergence of blockchain networks as “foundational operating systems for economic activity on the internet” was creating an “enormous platform and infrastructure opportunity” in which stablecoins play a vital role.

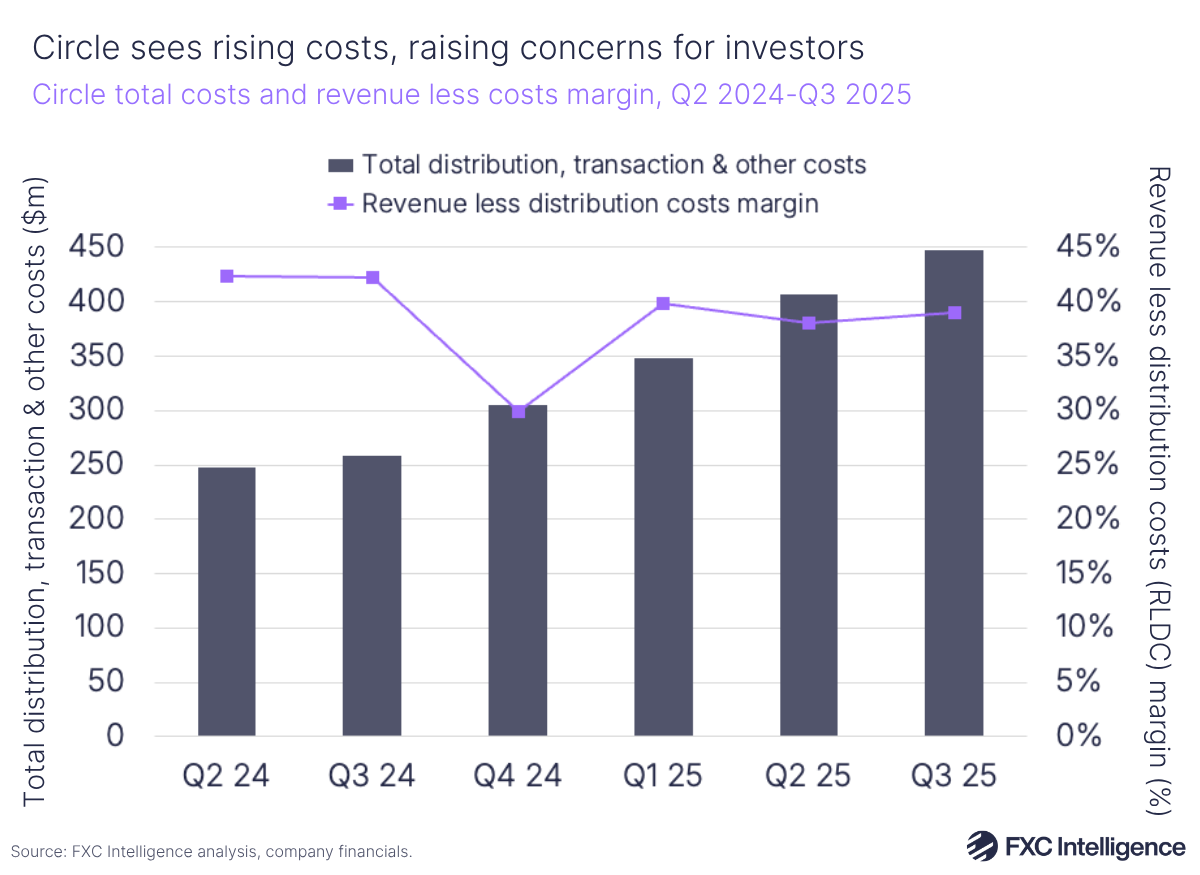

Cost rises create headwinds for Circle

Despite surging growth in use of USDC, Circle has also faced some headwinds in the form of rising costs, with the company’s total distribution, transaction and other costs seeing a 74% YoY increase to $448m. This meant revenue less distribution costs (RLDC) saw lower growth than overall revenue, meaning that Circle’s RLDC margin dropped from 42% in Q3 24 to 39% in Q3 25.

Crucially, the biggest driver of this cost increase was not investment, but payments it makes to Coinbase and other strategic partners. Because Circle and Coinbase originally created USDC together and have since reached an agreement for Circle to take full ownership of the stablecoin’s operations and management, Coinbase retains a deal where Circle has to pay it for any of the stablecoins held on its platform.

Circle has been making concerted efforts to increase the share of USDC it holds itself, and has seen positive results here, with the company holding 14% of USDC in Q3 25, compared to just 2% in Q3 24. However, Coinbase’s share has also increased from 23% to 24% over the same period.

These increased costs appear to have raised concerns for some investors, with the company’s share price tumbling by more than 12% on the publication of the results. However, the rate of reserve income the company is earning may also be a factor.

While the amount of stablecoin in circulation, and therefore the reserve values to earn interest on, is significantly higher than a year ago, the interest rates remain significantly below past highs. In 2024, the quarterly reserve return rate saw an average of 4.98%; in the first three quarters of 2025 the average has been 4.15%.

Non-reserve revenue takes growing share

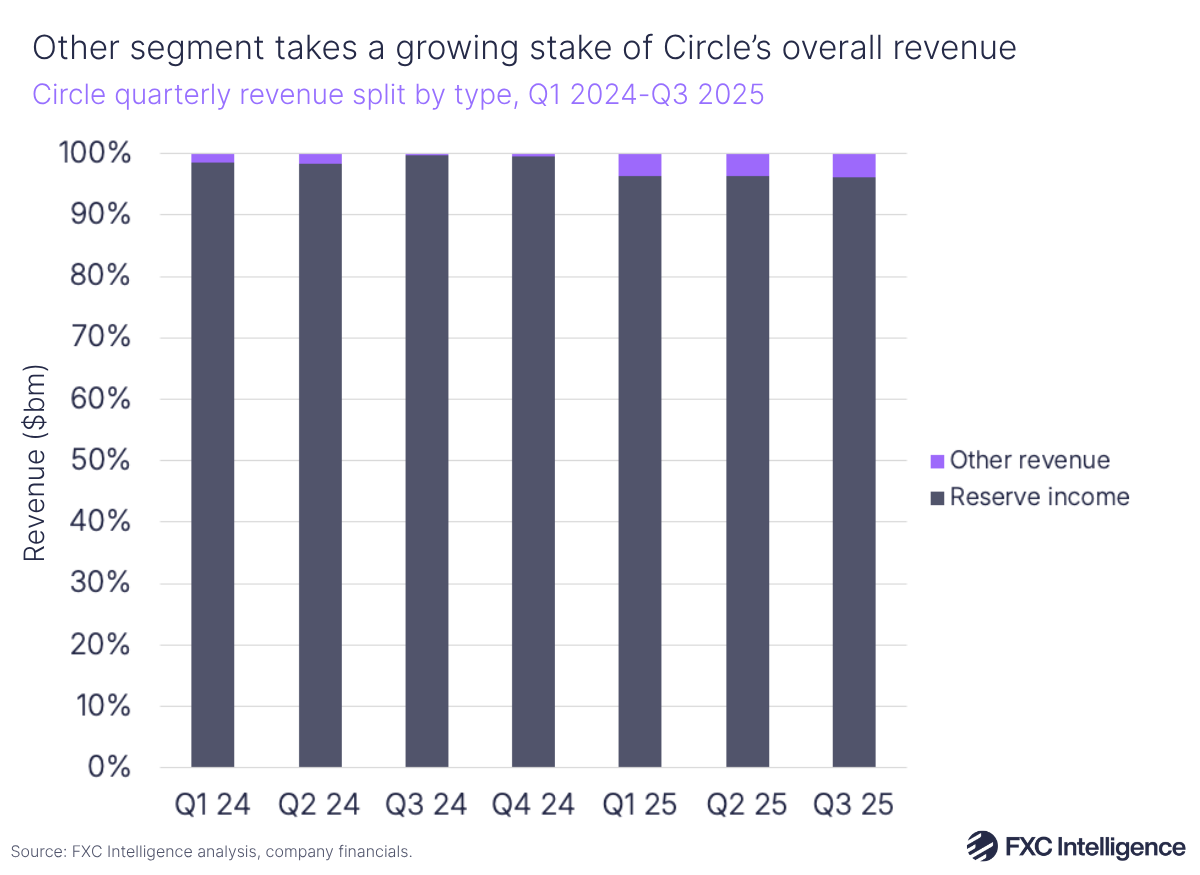

One of Circle’s biggest challenges as a public company was always going to be its high level of reliance on income it receives from the interest it generates on its stablecoin reserves, and the company has sought to diversify this through additional solutions reported under its Other revenue line.

This largely comprises subscriptions and services, including fees related to its tokenised money market fund product USYC, and transaction revenue, including fees associated with the redemption of its stablecoins and use of its cross-chain transfer protocol to move tokens between blockchains. While this revenue segment is still a small portion of the company’s overall revenue, it is growing quickly, climbing 2,752% YoY compared to reserve income’s 60% growth. In Q3 25, other revenue accounted for 4% of total revenue – up from 0.2% in Q3 24.

Circle Payment Network sees early growth while Arc readies for release

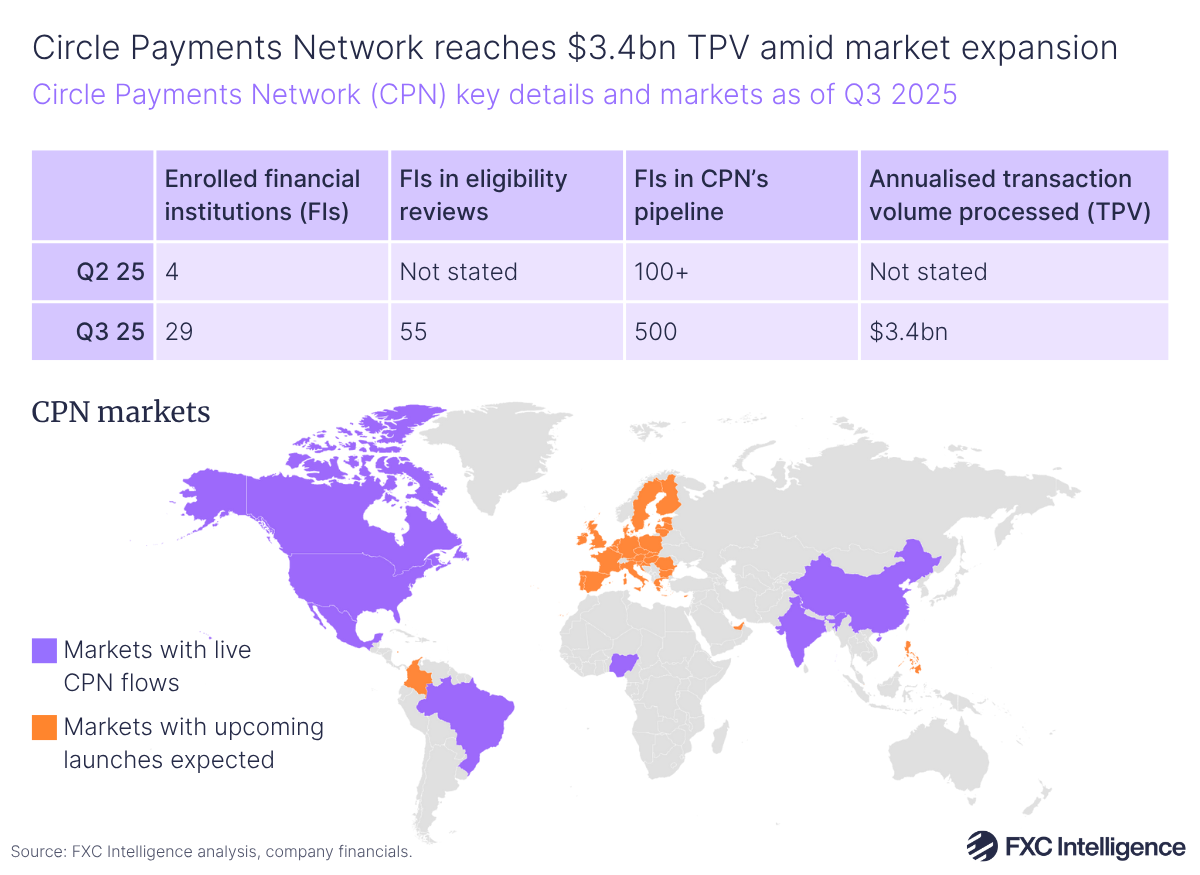

Although not yet a revenue-generation priority, the fledgling Circle Payments Network (CPN) may eventually prove to be a crucial source of income for the company, and in this quarter the company reported the first tangible metrics related to the product. Connecting financial institutions looking to make cross-border payments using stablecoins, with Circle handling governance and acting as its network operator, CPN went live in May of this year.

While in Q2 2025 the company reported just four enrolled financial institutions, this number has grown to 29 in Q3, with a further 55 in eligibility reviews. Circle has also provided the first sense of flows on the network, reporting that CPN currently sees annualised transaction volume processed of $3.4bn.

At present Circle has named eight markets with live flows, including Brazil, China, Mexico, India and the US, with further launches expected in key European, Asian and Latin American markets.

Allaire stressed that the company is priorising “quality not quantity” in participants, and is currently focusing on improving and growing the network rather than extracting value.

Beyond CPN, the company also provided an update on its planned Layer-1 blockchain Arc, which has seen its public testnet launched in the last month and is set for full market launch in 2026.

Designed to better suit traditional payments players than currently available blockchains, through features such as high transaction volumes and fixed costs, Arc is currently undergoing testing with over 100 players from access the industry, including Goldman Sachs, HSBC, Visa, Mastercard, LianLian Global and Nuvei.

Circle also announced that it is planning to launch its own native token for the blockchain, which may provide incentives for companies to use the blockchain as well as help in its management and governance.

“We really see the potential benefit of a native token for Arc that can provide utility for users of the network, that can align incentives around the growth of the network and that provides a concrete way for stakeholders to participate in governance around choices in terms of the technology and its upgrades, and choices in terms of the expansion of the operators on the network,” explained Allaire.

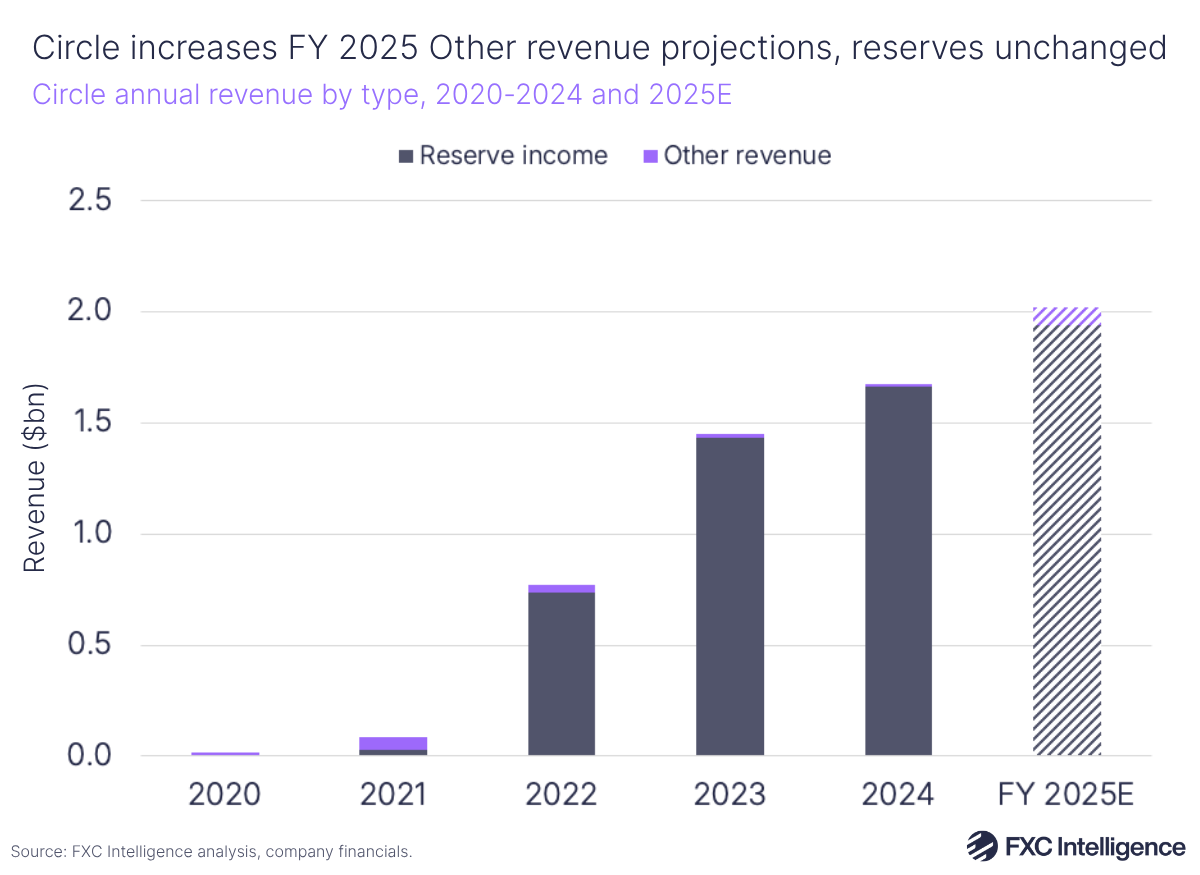

Circle raises other FY projections, but reserve income unchanged

Looking to FY 2025, Circle has not made any radical adjustments to its full-year projections, although has made some tweaks. It has retained its guidance of USDC circulation, which it expects to see rise at a 40% CAGR for the next few years. This, along with a relatively unchanged reserve return rate versus the previous quarter, means the reserve income projection for FY 2025 in our analysis remains the same as a quarter ago, translating into around a 17% YoY increase.

However, the company has significantly upped its expectations for Other revenue from $75m-85m to $90m-100m, which translates into a projected jump of around 525% YoY for the segment and 21% for revenue overall.

RLDC margin, meanwhile, is at the higher end of its previous projections, but at 38% is likely to be slightly lower than 2024’s average of 39%. This is accompanied by an increase in projected adjusted operating expenses, which the company had previously expected to reach $475m-490m, but is now expected to climb to $495m-510m.

This increase is largely the result of the company’s ongoing investment in its platform and global partnerships, which it considers critical as it looks to grow CPN, Arc and beyond.